Last updated on: April 10th, 2025

Legal Sports Betting Revenue Tracker – Sportsbook Revenue By State

As state gaming commissions release their monthly reports, we keep track of the US sportsbook revenue by state. Helpful to predict future industry numbers, this legal sports betting revenue tracker offers a view into the multi-billion-dollar industry.

- The states with sports betting have different methods for distributing data. But this page is updated as needed to consolidate the data for the ease of understanding.

Don’t leave making money just up to the sportsbooks. Earn your winnings at Bovada, which is one of the highest-producing sportsbooks for US players in terms of money. And we’re not talking about poker rooms or the casino, even though Bovada has them too. Whether playing in the NFL Pick Em Tournament, filling out their March Madness Contest brackets, or taking it one game at a time, they make betting fun. Plus, they pay out players in seconds, allowing you to get your winnings instantly.

- Exclusive Bonus Code

- 50% up to $1000

- Use code BVD1000 in Cashier

Sports Betting Revenue By State

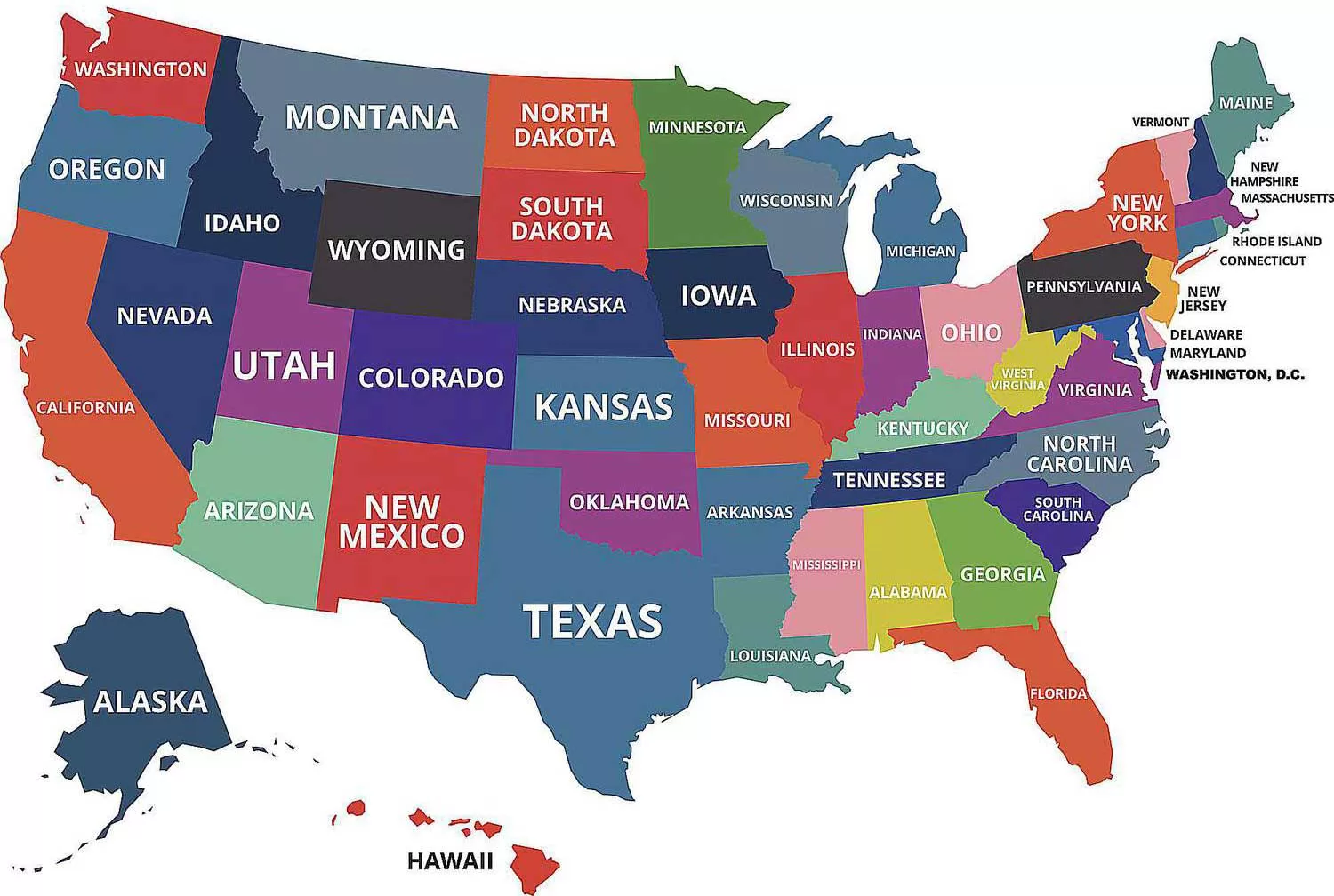

Regulated sports betting exists in almost the entire country, though not every state reports their handle or winnings. With legal sports betting everywhere, we’ve compiled monthly revenue reports from states’ gaming commissions to show a look into how much revenue sportsbooks in the US make.

- The first year for each state may not represent an entire calendar year, as their numbers start when they launched that year.

- Even though Nevada previously had sports betting, we started compiling in June 2018 – the first full month after the repeal of PASPA.

- All states are accurate through 2024, with 2025 sports betting revenue filtering in through the summer.

Nevada

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2018 | $3,021,298,706 | $193,929,000 | 6.419% | $13,090,209 |

| 2019 | $5,318,922,640 | $329,037,000 | 6.186% | $22,210,000 |

| 2020 | $4,339,486,867 | $262,800,000 | 6.056% | $17,739,004 |

| 2021 | $8,147,648,361 | $445,116,000 | 5.463% | $30,045,332 |

| 2022 | $8,633,518,183 | $449,071,000 | 5.201% | $30,312,296 |

| 2023 | $7,417,452,705 | $422,307,000 | 5.693% | $28,505,726 |

New Jersey

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2018 | $1,247,307,720 | $94,022,393 | 7.538% | $11,601,261 |

| 2019 | $4,582,898,150 | $299,398,035 | 6.533% | $40,268,621 |

| 2020 | $6,012,531,987 | $398,231,302 | 6.623% | $54,982,359 |

| 2021 | $10,927,585,885 | $814,981,641 | 7.458% | $112,736,461 |

| 2022 | $10,944,593,978 | $762,954,971 | 6.971% | $107,425,899 |

| 2023 | $11,972,320,289 | $1,006,681,602 | 8.408% | $141,517,468 |

Arizona

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2021 | $1,743,249,640 | $161,057,784 | 9.239% | $5,955,284 |

| 2022 | $6,036,844,930 | $482,932,555 | 8.000% | $28,914,694 |

| 2023 | $5,166,902,608 | $447,385,347 | 8.659% | $27,977,327 |

Mississippi

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2018 | $158,565,586 | $15,175,667 | 9.571% | $1,821,080 |

| 2019 | $369,173,582 | $44,451,371 | 12.041% | $5,334,165 |

| 2020 | $363,775,649 | $43,741,530 | 12.024% | $5,248,985 |

| 2021 | $586,086,026 | $65,868,088 | 11.239% | $7,904,172 |

| 2022 | $531,585,628 | $60,739,616 | 11.426% | $7,288,754 |

| 2023 | $425,387,043 | $46,337,369 | 10.893% | $5,560,485 |

West Virginia

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2018 | $47,796,234 | $6,623,563 | 13.858% | $662,356 |

| 2019 | $228,285,426 | $19,434,393 | 8.513% | $1,945,349 |

| 2020 | $400,741,355 | $27,286,723 | 6.809% | $2,728,673 |

| 2021 | $546,940,861 | $45,127,957 | 8.251% | $4,512,797 |

| 2022 | $571,317,850 | $50,822,381 | 8.896% | $5,082,238 |

| 2023 | $429,218,366 | $41,406,171 | 9.647% | $4,140,618 |

Pennsylvania

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2018 | $47,796,234 | $6,623,563 | 13.858% | $662,356 |

| 2019 | $228,285,426 | $19,434,393 | 8.513% | $1,945,349 |

| 2020 | $400,741,355 | $27,286,723 | 6.809% | $2,728,673 |

| 2021 | $546,940,861 | $45,127,957 | 8.251% | $4,512,797 |

| 2022 | $571,317,850 | $50,822,381 | 8.896% | $5,082,238 |

| 2023 | $429,218,366 | $41,406,171 | 9.647% | $4,140,618 |

Rhode Island

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2018 | $13,770,713 | $1,030,910 | 7.486% | $525,764 |

| 2019 | $245,811,496 | $17,806,694 | 7.244% | $9,081,413 |

| 2020 | $221,916,076 | $24,067,477 | 10.845% | $12,274,413 |

| 2021 | $454,457,990 | $38,751,495 | 8.527% | $19,763,261 |

| 2022 | $532,609,814 | $49,298,062 | 9.256% | $25,142,012 |

| 2023 | $365,101,422 | $32,717,606 | 8.961% | $16,685,978 |

Arkansas

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2018 | $13,770,713 | $1,030,910 | 7.486% | $525,764 |

| 2019 | $245,811,496 | $17,806,694 | 7.244% | $9,081,413 |

| 2020 | $221,916,076 | $24,067,477 | 10.845% | $12,274,413 |

| 2021 | $454,457,990 | $38,751,495 | 8.527% | $19,763,261 |

| 2022 | $532,609,814 | $49,298,062 | 9.256% | $25,142,012 |

| 2023 | $365,101,422 | $32,717,606 | 8.961% | $16,685,978 |

New York

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2019 | $67,960,787 | $7,783,423 | 11.453% | $778,343 |

| 2020 | $98,109,146 | $10,768,728 | 10.976% | $1,076,872 |

| 2021 | $197,476,663 | $23,321,149 | 11.810% | $2,332,112 |

| 2022 | $16,288,073,156 | $1,367,052,768 | 8.393% | $693,923,018 |

| 2023 | $19,196,867,479 | $1,697,297,617 | 8.842% | $862,582,466 |

Iowa

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2019 | $212,225,668 | $19,283,690 | 9.086% | $1,301,649 |

| 2020 | $575,248,472 | $41,623,877 | 7.236% | $2,809,753 |

| 2021 | $2,053,708,513 | $125,512,412 | 6.112% | $8,472,088 |

| 2022 | $2,348,065,964 | $165,551,990 | 7.051% | $11,174,759 |

| 2023 | $2,420,464,385 | $199,027,690 | 8.223% | $13,434,370 |

Oregon

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2019 | $45,272,116 | $2,924,340 | 6.459% | $1,462,171 |

| 2020 | $218,246,341 | $20,072,419 | 9.197% | $10,036,212 |

| 2021 | $331,599,514 | $30,398,008 | 9.167% | $15,199,008 |

| 2022 | $497,985,675 | $49,519,353 | 9.944% | $24,759,680 |

| 2023 | $601,820,650 | $65,963,483 | 10.961% | $32,981,744 |

Indiana

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2019 | $435,996,520 | $41,576,946 | 9.536% | $3,931,772 |

| 2020 | $1,769,270,606 | $136,395,416 | 7.709% | $13,165,417 |

| 2021 | $3,829,411,987 | $308,304,353 | 8.051% | $29,089,084 |

| 2022 | $4,467,882,215 | $386,888,311 | 8.659% | $36,797,945 |

| 2023 | $4,337,817,508 | $404,363,766 | 9.322% | $38,417,065 |

Montana

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2020 | $18,770,480 | $2,368,463 | 12.618% | $294,849 |

| 2021 | $47,215,732 | $6,406,223 | 13.568% | $1,010,790 |

| 2022 | $50,918,515 | $7,173,449 | 14.088% | $1,248,959 |

| 2023 | $62,258,820 | $8,446,611 | 13.567% | $1,332,437 |

Louisiana

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2021 | $67,388,583 | $10,066,406 | 14.938% | $1,006,641 |

| 2022 | $2,302,509,284 | $215,680,964 | 9.367% | $34,205,762 |

| 2023 | $2,528,091,484 | $310,789,087 | 12.293% | $35,876,138 |

Tennessee

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2020 | $312,344,523 | $27,124,908 | 8.684% | $5,443,918 |

| 2021 | $2,730,459,000 | $239,872,000 | 8.785% | $39,300,000 |

| 2022 | $3,850,547,906 | $379,409,891 | 9.853% | $68,052,961 |

| 2023 | $4,292,352,235 | $451,028,296 | 10.508% | $83,557,513 |

Maryland

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2021 | $16,552,430 | $3,170,001 | 19.151% | $469,297 |

| 2022 | $979,584,836 | $149,480,586 | 15.260% | $6,100,504 |

| 2023 | $4,617,323,134 | $514,081,188 | 11.134% | $46,165,906 |

Virginia

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2021 | $3,221,790,714 | $285,895,559 | 8.874% | $20,340,023 |

| 2022 | $4,914,954,449 | $481,233,605 | 9.791% | $51,765,686 |

| 2023 | $4,315,837,488 | $453,263,732 | 10.502% | $58,350,376 |

New Hampshire

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2021 | $3,221,790,714 | $285,895,559 | 8.874% | $20,340,023 |

| 2022 | $4,914,954,449 | $481,233,605 | 9.791% | $51,765,686 |

| 2023 | $4,315,837,488 | $453,263,732 | 10.502% | $58,350,376 |

Connecticut

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2021 | $336,444,408 | $33,267,269 | 9.888% | $3,154,423 |

| 2022 | $1,519,890,754 | $145,306,247 | 9.560% | $14,525,092 |

| 2023 | $1,550,846,647 | $159,435,590 | 10.281% | $16,967,075 |

South Dakota

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2021 | $2,651,489 | $254,582 | 9.601% | $22,913 |

| 2022 | $7,192,829 | $1,046,997 | 14.556% | $94,229 |

| 2023 | $7,890,753 | $855,833 | 10.846% | $77,026 |

Washington DC

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2021 | $2,651,489 | $254,582 | 9.601% | $22,913 |

| 2022 | $7,192,829 | $1,046,997 | 14.556% | $94,229 |

| 2023 | $7,890,753 | $855,833 | 10.846% | $77,026 |

Michigan

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2020 | $130,763,498 | $18,276,857 | 13.977% | $1,535,256 |

| 2021 | $3,965,906,303 | $319,522,216 | 8.057% | $13,612,812 |

| 2022 | $4,814,088,969 | $418,647,137 | 8.696% | $22,059,404 |

| 2023 | $4,197,478,178 | $368,517,713 | 8.780% | $19,450,529 |

Wyoming

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2021 | $40,348,146 | $4,012,816 | 9.945% | $111,914 |

| 2022 | $144,522,130 | $14,787,230 | 10.232% | $843,171 |

| 2023 | $153,223,568 | $15,444,324 | 10.080% | $922,831 |

Colorado

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2020 | $1,185,754,618 | $75,841,207 | 6.396% | $2,965,322 |

| 2021 | $3,847,527,102 | $250,048,945 | 6.499% | $11,701,499 |

| 2022 | $5,181,758,903 | $351,950,255 | 6.792% | $19,634,715 |

| 2023 | $4,235,313,749 | $322,823,162 | 7.622% | $22,251,879 |

Illinois

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2020 | $1,882,620,542 | $137,410,656 | 7.299% | $20,191,143 |

| 2021 | $7,021,763,064 | $534,086,819 | 7.606% | $84,691,181 |

| 2022 | $9,751,301,251 | $806,195,859 | 8.268% | $127,668,464 |

| 2023 | $8,931,018,896 | $809,684,491 | 9.066% | $128,816,132 |

All States

| Year | Yearly Betting Handle | Sportsbook Revenue | Hold Rate | Tax Responsibilities |

|---|---|---|---|---|

| 2022 | $4,506,326,636 | $313,298,122 | 6.952% | $28,606,642 |

| 2023 | $13,008,349,237 | $894,803,020 | 6.879% | $116,787,191 |

| 2024 | $21,516,361,612 | $1,537,352,103 | 7.145% | $233,351,369 |

| 2025 | $57,643,256,951 | $4,329,879,307 | 7.512% | $561,385,988 |

| 2026 | $92,914,954,162 | $7,501,015,109 | 8.073% | $1,501,155,758 |

| 2027 | $95,231,336,904 | $8,486,914,348 | 8.912% | $1,765,960,341 |

States With Most Tax Revenue

| State | Tax Revenue | Tax Rate |

|---|---|---|

| New York | $2,846,083,525 | 51% |

| Pennsylvania | $736,579,860 | 36% |

| Illinois | $724,096,708 | 15% |

| New Jersey | $650,993,458 | Varies |

- Over 60% of the sports betting tax benefits in the US come from these four states: New York, Pennsylvania, Illinois, and New Jersey.

- New York is the largest benefiter of sportsbook taxes, seeing roughly 35% of the U.S. total due to their high handle and massive tax rate.

Sports Betting Revenue News

$2B Deficit Puts Indiana Sports Betting Tax in Spotlight

Indiana faces a projected $2 billion revenue shortfall over the next two years, forcing lawmakers to consider new revenue sources and potential budget cuts. With the state’s sports betting industry now taking in roughly $5 billion annually, raising Indiana’s low 9.5%...

DraftKings Q4 2024 Report Shows Path to Profitability… But At What Expense?

DraftKings reported a $200 million net loss in Q4 2024 despite a 13% revenue increase year-over-year, highlighting ongoing profitability challenges. The company secured a $500 million loan to fuel expansion, with a strong focus on iGaming as a potential path to future...

Why Nevada Sportsbooks Need an Online Registration Option

Nevada’s in-person sign-up rule for mobile betting limits its market share, recording the seventh-highest sports betting handle ($7.89 billion) in 2024. Eliminating in-person registration could boost mobile betting participation, letting them compete for the 4th spot...

How Colorado Sports Betting Is Funding Real-World Issues

Colorado sportsbooks collected over $443 million in revenue after paying the state nearly $32 million in tax benefits during 2024. After seeing $5.1 billion in bets for 2022 and $5.5 billion for 2023, Colorado bettors broke the $6 billion marker in 2024. DENVER -...

Mississippi Sportsbooks Surpass $3 Billion in Betting Handle

Mississippi sportsbooks have taken in $3,021,531,031 in legal sports bets since their August 2018 launch. The industry has generated over $327 million in revenue and $39.3 million in tax benefits. Betting surged in early years, but the annual handle declined from 2022...

Vermont’s First Year of Sports Betting By the Numbers

Basketball was the most bet on sport in Vermont for 2024. The first year of action saw VT sportsbooks collect nearly $200 million from sports bets. The State of Vermont received over $6.3 million in sports betting taxes from Year 1. Tennis saw a high percentage of...